Summary

This proposal seeks approval to allocate $300,000 from gTrade’s overcollateralization layers (OC) to fund a December trading competition, running for approximately three weeks and concluding before the end of this year.

Given that the community discussions reflected mixed but strong appetite across different contest formats, this proposal does not prescribe a fixed structure. Instead, it presents multiple structure options for Snapshot voters to choose from.

The Snapshot vote will include the following options:

-

$300k — Hybrid (PnL + time-weighted volume)

-

$300k — Time-weighted volume only

-

$300k — PnL-only

-

No contest

Structure rules:

-

“No contest” only passes if it receives >50% of total votes.

-

Otherwise, whichever option among the three contest formats receives the highest votes will be implemented.

If approved, the OC-pull will be executed immediately so the contest can begin in early December.

Context & Background

1. Trick or Trade Retrospective (High-Level)

After the Trick or Trade campaign (Oct 22 - Nov 19), a retrospective was published as an addendum on the governance forum to inform GNS holders on the its impact, ROI, and key takeaways.

Key outcomes (see Dune for more):

-

2.2x total volume vs. prior 30 days

-

2.75x core volume

-

2x fees, with fee ROI landing around 1:1 (or 1.2x excluding excess marketing costs)

-

+$130K total vault PnL, +$260K core vault PnL

-

750,000+ GNS burned (≈2.75% of supply at the time writing)

-

Material increase in core OI, validating the v10 funding-fee model

-

Strong sentiment improvement and community engagement

-

Completion of the milestone required to unlock a $150k grant

- Team commits to using these grant funds for a Q1 2026 Arbitrum-exclusive contest

In short: Trick or Trade laid a strong foundation for v10 by demonstrating healthier market behavior, stronger economics, and the conditions needed to compound growth going forward.

2. Community Temperature Check (Telegram: Nov 24–25, 2025)

A two-part poll was conducted to assess appetite for a December contest, its size, and potential structures:

Final results of the community temperature check on Telegram (November 26, 2025)

Community consensus clearly favors a meaningful December contest but is somewhat divided on structure.

Based on the Trick or Trade results, its learnings outlined in the retrospective, and the current state of the OC layers — the team shares the community’s preference and is confident that a $300k contest is an appropriate and sustainable next step. Additionally, the team is slightly in favor of a hybrid contest structure.

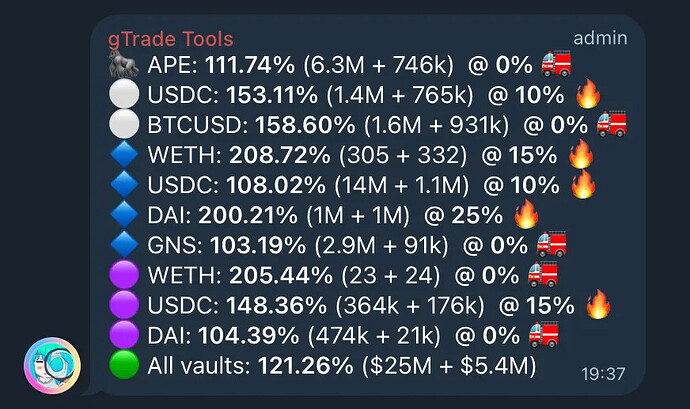

Current state of gTrade’s vaults and OC-layers (November 26, 2025)

Rationale for a December Contest

1. Sustain v10’s Momentum

v10 materially changed gTrade’s market dynamics:

-

Funding fees on core markets now hedge risk more effectively

-

Core markets can absorb significantly more demand and volatility

-

OI limits were gradually increased during Trick or Trade as risk was balanced via arbitrage participation

-

Traders have begun experiencing gTrade as a platform that supports longer-held directional trades

A December contest leverages this momentum rather than letting it dissipate into year-end.

2. Strong Token-Level Alignment via BB&B

At current market prices and BB&B active, an OC-funded contest effectively acts as an indirect accelerant for token-level alignment:

-

More volume → more fees → more BB&B → greater GNS deflation

-

Fees + PnL from core markets continue to strengthen protocol economics

3. Bridge to Q1 Campaign

The protocol has successfully unlocked a $150k grant on Arbitrum, but:

-

KYB is complete

-

Funds have not yet been transferred

-

Timelines are too tight to rely on the grant for a December campaign

Thus, an OC-funded December contest serves as a bridge event, followed by another major Arbitrum-exclusive campaign in Q1 2026 using the grant.

4. Retention of Newly (Re)activated Traders

Trick or Trade brought back dormant or churned users.

To retain them, the follow-up must be:

-

Timely

-

Familiar (with similar mechanics)

-

Sized meaningfully enough to justify continued activity

- eg. relative to alternative incentive opportunities available across the perp DEX vertical, previously outlined in “Market Context & Rationale,” which continues to be relevant for this December campaign.

A December campaign ensures the activity curve remains elevated going into Q1.

Details of Proposed December Contest

Contest Duration

- ~3 weeks, ending before EOY

Eligible Networks

-

Arbitrum

- and gTrade Solana

Collateral Eligibility

- USDC on Arbitrum

Requested Action

This proposal seeks community approval via Snapshot to allocate $300,000 from the OC layers to fund a December contest.

Voters will choose between:

-

$300k — Hybrid (PnL + time-weighted volume)

-

$300k — Time-weighted volume only

-

$300k — PnL-only

-

No contest

Decision rule:

-

“No contest” must receive >50% of all votes to win

-

Otherwise, the highest-voted contest structure is adopted

If passed, the contest implementation begins immediately.

Conclusion

The community has shown overwhelming support for another contest, and Trick or Trade demonstrated that:

-

v10 is delivering the intended behavior shift

-

The contest model works

-

Traders, GNS holders, and the protocol all benefit

-

Competitive pressure across perp DEXs remains high

-

Maintaining momentum into EOY and Q1 is strategically important

This proposal empowers GNS holders to choose the format they prefer while ensuring momentum continues into the holiday period and into the Q1 Arbitrum-funded campaign.

We invite all GNS holders to participate in this Snapshot vote and help shape the next phase of gTrade’s growth.