Overview

This proposal suggests allocating up to $300,000 from the over-collateralization (OC) layers across gTrade’s vaults to fund a major trading competition and marketing campaign, intended to launch alongside the v10 upgrade (OI Hedging). The initiative will be designed to attract new traders, boost trading volumes, and accelerate third-party adoption by integrators and arbitrageurs testing the upgraded model. This forum discussion also aims to collect feedback beyond the community chats and help finalize the structure of the proposal before moving to a Snapshot vote.

Justification

- Why this is needed: The upcoming v10 release is a pivotal upgrade that solves key limitations of the existing borrowing fee model, particularly around OI caps and holding fees for traders. To fully capitalize on this improved design, the team recognizes the need to attract and retain traders and integrators for the model to prove itself. A well-timed campaign could demonstrate product-market fit under the new mechanics and signal confidence in the protocol’s scalability.

- Supporting data/analysis:

- Historical trading contests have often resulted in positive PnL for the vaults — driven by aggregate negative trader PnL across multiple incentive periods — and significantly increased trading volumes, which translates to higher fee revenue for the protocol and gToken LPs. These outcomes make an OC-funded campaign strategically viable. Given that $GNS holders ultimately serve as counterparties to trader PnL, it is appropriate that this decision be governed via a $GNS vote.

- Previous contests elevated trading volume during the incentivized periods, but suffered from high churn rates due to OI caps and relatively high holding fees — two friction points that v10 aims to solve.

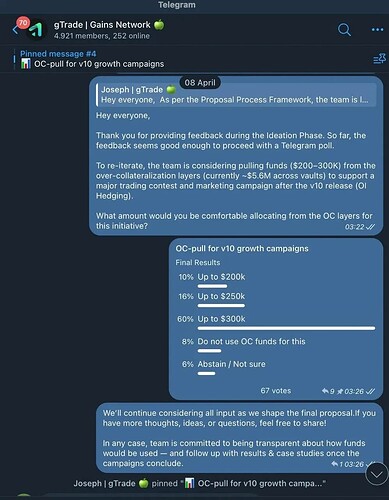

- As per the Proposal Process Framework, the team initiated the Ideation Phase on April 5 to gather community input. A temperature check via Telegram confirmed strong support for an OC-pull of up to $300K. Screenshots are included below.

- Community benefit:

- Increased trading volume and protocol revenue.

- Better user experience for both traders and integrators post-v10.

- Broader visibility and better odds for long-term momentum for the gTrade ecosystem.

Impact Analysis

- Expected outcomes:

- Increased trading activity following the release of v10.

- Higher user retention due to the improved UX.

- Onboarding of new integrators and arbitrageurs.

- Metrics for success:

- Volume and revenue growth during and after the campaign.

- Vault performance (fees and Trader PnL).

- Trader/integrator adoption and retention.

- Reach and engagement from marketing efforts.

- Timeline:

- Forum discussion: April 17 - 22

- Snapshot vote: April 23 - May 1

- Fund withdrawal and deployment: Post-v10 release.

- Campaign execution: Estimated within 1–2 weeks post-v10, running for approximately 1–2 months.

Risks and Mitigations

- Potential downsides:

- Market volatility may affect vault health prior to campaign execution, potentially requiring capital preservation.

- The campaign might underperform in terms of new user conversion or volume uplift.

- Risk mitigation strategies:

- The team will continuously monitor vault health and execute the OC-pull only if conditions are favorable.

- Campaign size and timing remain flexible and will adapt to real-time performance and OC availability.

- The team will communicate its decision-making process transparently and publish a detailed case study post-campaign(s) to help inform future initiatives and stakeholder evaluations.

- Contingency plans:

- Depending on vault conditions, the pull size may be reduced or delayed. The same flexibility applies to which vaults contribute, based on the state of their over-collateralization layers.

- Messaging and strategy can be adapted mid-campaign to maximize effectiveness and reach.

Implementation

- Technical requirements:

- No technical changes required beyond internal fund management and distribution systems.

- Timeline:

- Planning begins immediately after approval.

- Execution aligned with v10 rollout, estimated within 2 weeks post-launch.

- Required resources:

- Up to $300K from over-collateralization layers.

- Team bandwidth for marketing (potentially in collaboration with an agency), contest management, analytics, and reporting.

The team is committed to full transparency. Once the campaign concludes, a detailed breakdown of how funds were used, along with results and case studies, will be shared with the community.